Central to the BlackBoxStocks platform is the concept of unusual options flow. Grasping what options flow is and how it can be interpreted and incorporated into a trading strategy is a formidable approach. The final installment of our beginner’s series on options trading will delve into a two-part examination of options flow. This part will acquaint the options trader with options flow, while the following installment will detail how BlackBoxStocks instructs traders to interpret it. So, what exactly is options flow?

Understanding Options Flow: An Introduction

This article presupposes that the reader is familiar with the fundamental aspects of options trading, such as time to expiry, theta, delta, implied volume, open interest, bid and ask, single leg options, multi leg options, spreads, calls, and puts. These elements are crucial to understanding options flow. If you’re not conversant with these aspects, we recommend revisiting our earlier installments.

Options flow offers a means to monitor institutional money as it’s channeled into options trades. Learning to follow the “flow” can be invaluable. But what does it mean?

Options flow traces the movement of large volumes of options contracts. Much like traders can track stock transactions’ time and sales, options flow provides insight into where money is being invested in options. This data isn’t typically accessible to the public via brokers; an options flow scanner is required to view options flow activity.

Gaining Insight with BlackBoxStocks

BlackBoxStocks members benefit from our intelligent options flow which provides real-time insight into these transactions and unusual options activity. As soon as an order is filled on the exchanges, we see the transaction’s size and price. Volume, as all traders know, is a crucial data point for any trading plan. Seeing the volume of options contracts being traded at any given moment can inform a trading strategy.

In essence, options flow focuses on large institutional buys across the exchanges. Often, the options flow you see on our scanners represent investments of hundreds of thousands, if not millions, of dollars. These substantial institutional purchases of a decaying asset can vary in expiry. However, some of these flows are in weekly options, and the idea is that if the “smart money” is investing such significant sums into a multitude of decaying call or put contracts, their trading thesis is likely well-informed. Moreover, the concept of “unusual options flow” is a potent iteration of the data. If you observe a large flow in a ticker that usually doesn’t experience that much volume, it can be advantageous to follow. This “unusual” options flow may be larger than the typical volume the ticker sees.

Reading and Interpreting Options Flow: A Line-by-Line Analysis

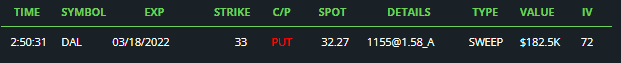

While options flow is a powerful tool, understanding how to interpret the flow and apply it to your trading theses requires training and education. Let’s examine an individual line of flow to illustrate the data BlackBoxStocks members have access to. Flows can consist of multiple lines, and each line reveals a lot about the purchase. The graphic below provides information from left to right.

The first column represents the exact time the buyer’s order was filled. Some services offer delayed data, but BlackBoxStocks data is real-time. In fact, our proprietary scanner delivers the information before it appears in the buyer’s account. This option purchase was filled precisely at 2:50:31 pm, Eastern Standard Time.

“SYMBOL” denotes the ticker of the options. For instance, in this case, this line of options flow is for $DAL ‘Delta Airlines.’ “EXP” is the expiration date for the options. This flow appeared on the scanner on Friday, March 11th, with a selected expiration date of March 18th, 2022, just one week away. “STRIKE” is the selected strike price. In this case, the chosen strike price was $33.

“C/P” indicates if the transacted options are calls or puts. This transaction involved puts.

“SPOT” represents the price of the underlying asset when the options were purchased. In this example, Delta Airlines stock was trading at $32.27 when this order was filled.

“DETAILS” provide crucial information about the flow in this order, such as the number of contracts involved in the transaction, the contract price, and where the price filled on the bid-ask spread. In this instance, this transaction comprised 1,155 contracts at a price of $1.58, filled on the ask, suggesting it was likely a buy.

“TYPE” will either be a Sweep or a Block, different types of transactions with distinct implications. A block is a pre-negotiated purchase filled on one exchange, while a sweep is a more urgent transaction, involving multiple exchanges to fill a large order quickly. Understanding the difference is crucial, as sweeps and multiple blocks can greatly influence the options flow puzzle.

“VALUE” denotes the total transaction cost. In this case, the purchaser bought $182,500 worth of puts expiring the following week. If you’re familiar with the basics of delta and theta, this value can be of extreme interest. With the strike price close to the spot price, this is likely an approximately .5 delta, which could result in significant profits if the purchaser’s bet that the underlying will fall is correct. Additionally, they must believe it will happen soon, given the substantial cumulative theta burn on this number of contracts with a week-long expiry.

“IV” stands for implied volatility at the time of the transaction. As a reminder, implied volatility is an estimate of the potential appreciation or depreciation of the underlying price over the life of the options contract. Generally, it’s advantageous to buy options during periods of low implied volatility and sell them when implied volatility is high.

As you can see, a single line of options flow contains a wealth of information. Throughout a trading day, thousands of lines of flow cross the scanner. Some are significant; others are not. It’s not enough to merely know what each element in the flow represents. You must interpret the story that options flow is telling, which requires education, training, and experience.

For instance, if the above line of flow represents a purchase, the buyer of these puts must strongly believe that a move to the downside is imminent. This is a significant number of contracts bought at the ask. They didn’t wait and scale into this size, seeking to save some premium on small fluctuations along the way. They wanted in immediately and were comfortable buying over 1,100 contracts at the ask during that trading session. They also executed this on a Friday afternoon, indicating a potential expectation for a very short-term move and possibly closing these contracts for a profit before the trading session ended that Friday. Of course, you can’t know the intention at the time if you see this flow come across the scanner in real-time. So, if this was a very short-term intraday trade thesis, perhaps they were expecting Delta Airlines to fall significantly that very day. And if not, they were willing to hold these contracts over the weekend until at least the following Monday. Given the amount of theta that would be extracted in the final three days of these contracts, one can assume that IF this was a buy, they must expect a downside move in the relatively near future. As a result, a retail trader with access to this flow and the ability to read it might feel comfortable following this put trade. Of course, no one will buy 1,100 contracts! However, even a small number of contracts, or even a single one, can yield a nice gain for an options flow trader if there is a substantial downside move.

The Power of Learning Options Flow Trading

Options flow can be a potent addition to any option trader’s toolkit. However, it’s not sufficient to simply gain access to an options flow scanner and watch the trades as they happen. Education must accompany this. From determining which order flow to monitor to which order flow to select, the data must be interpreted correctly. Stock and ETF flow have different characteristics and applications. Often, flows are part of intricate multi-leg options deals, which also carry implications. The above example is a single line of flow, but flows are best read in conjunction with other lines of flow on the same ticker. This requires learning and deciphering more information. There are ways to tell if the calls or puts are being opened or closed. It’s possible to discern when writing is happening versus simply buying. However, it requires time, effort, and education to make these distinctions. Merely learning what the information means and following single lines of flow that appear to tick all the favorable boxes isn’t enough.

That’s why next week’s final installment in our options trading for beginners series will feature the BlackBoxStocks method of interpreting flow, as taught by our in-house flow trading specialist moderator. We’re excited to conclude our series with a close focus on how flow is taught, interpreted, and traded within our community.

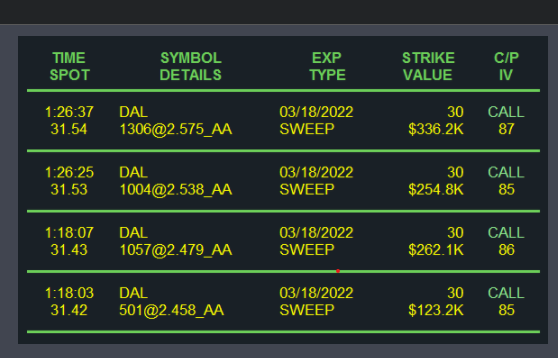

For instance, below is an example of the flow plays that our members receive on their phones via our BlackBoxStocks app, included with membership:

This order flow is far more convincing than the aforementioned DAL put example; it has a higher probability of yielding profit if followed. We’ll discuss this in detail next week, bringing you a technical article featuring BlackBoxStocks flow strategies, options alerts, flow plays sent to our members’ phones, as well as the Understanding Options Flow class, an integral part of our BlackBoxStocks community.

If you find this a lot to digest, you’re correct! By nature, options trading is a complex endeavor that becomes more manageable and comprehensible with time and experience. Options flow trading is no different. There are many moving parts and financial risk involved (as always with all types of trading). However, with study, skill, and experience, that risk can be mitigated. Learning options flow trading is a powerful and beneficial undertaking. If you proceed attentively and carefully, the details will become clearer to you over time. In fact, with the right teacher, it may take less time than you might expect. Next week, we will feature the BlackBoxStocks approach to Options Flow trading. Thank you for reading; see you then.